Understanding the debt review process can help you feel more confident about taking this important step. Here is exactly what happens at each stage — from your first conversation with a debt counsellor to the day you receive your clearance certificate.

Free Assessment & Consultation

The process begins when you contact a registered debt counsellor. At DS4U, this starts with a free WhatsApp assessment — no forms, no office visit, no obligation.

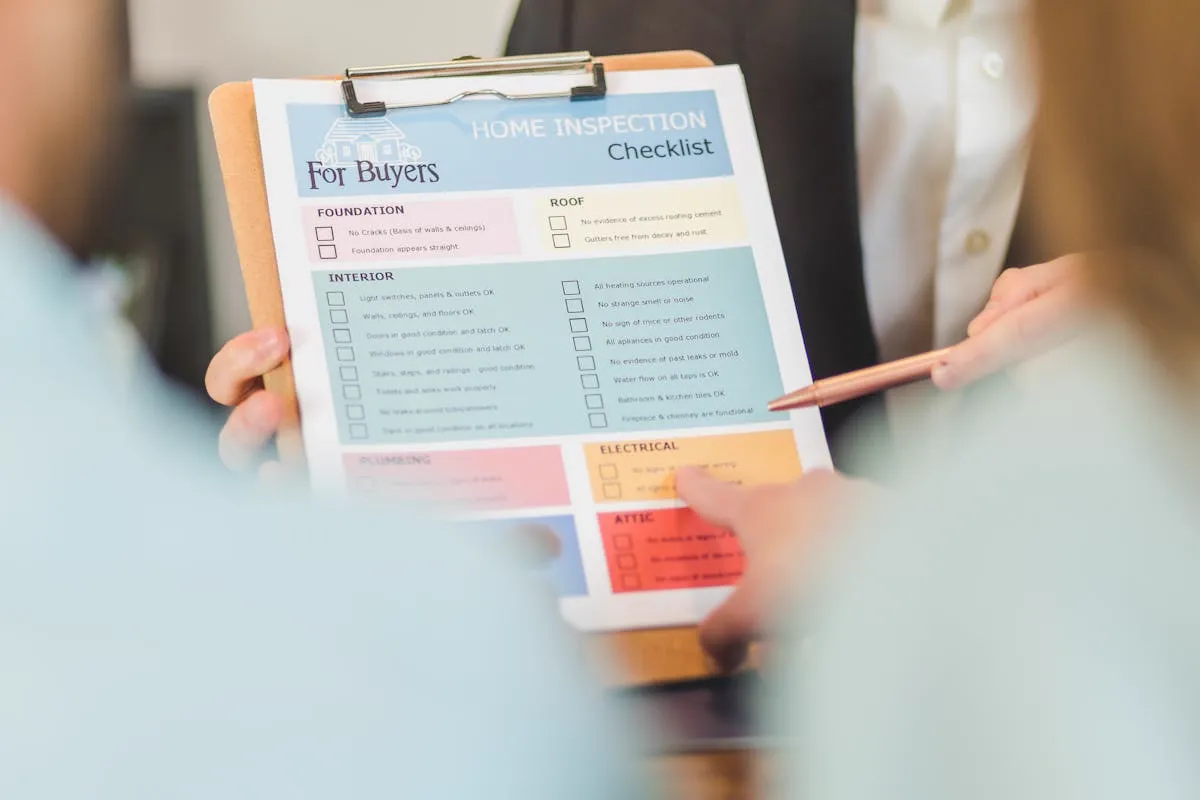

During the assessment, your debt counsellor will review your income, expenses, and all your debt obligations. They will calculate your debt-to-income ratio and determine whether you qualify as over-indebted under the National Credit Act.

If you qualify, the counsellor will explain exactly how debt review will work for your specific situation, including estimated reduced payments and timeline.

Application & Form 16

Once you decide to proceed, you formally apply for debt review by signing the application documents. Your debt counsellor issues a Form 16 — the official notice that you have applied for debt review.

This form is sent to all your creditors and the National Credit Regulator (NCR) within 5 business days. From this moment, you have legal protection — creditors must pause any legal action against you.

Financial Assessment (Form 17.1)

Your debt counsellor conducts a detailed assessment of your complete financial position. This involves gathering your payslips, bank statements, and all credit agreement details.

The counsellor will verify all debts directly with your creditors to confirm outstanding balances, interest rates, and payment terms. They compile this into a Form 17.1 — your official certificate of balance.

This thorough assessment ensures that every debt is accounted for and the restructured plan is built on accurate information.

Restructured Proposal

Based on the assessment, your debt counsellor creates a restructured repayment proposal. This includes negotiating with each creditor to reduce interest rates (often to as low as 0% on certain accounts) and extending repayment periods.

The proposal outlines a single monthly payment amount that covers all your debts. This payment is designed to be affordable — typically 30-50% less than what you were paying before.

The proposal is sent to all creditors for their acceptance. Most creditors accept because they know it is better to receive reduced payments than risk the consumer defaulting entirely.

Court Application (Consent Order)

Once creditors accept the proposal (or if they do not respond within the required timeframe), the plan is submitted to the magistrate's court for a consent order.

The consent order is a legally binding court order that makes the restructured repayment plan official. Both you and your creditors must comply with its terms. This provides you with the strongest legal protection available.

With DS4U, you do not need to appear in court — your debt counsellor and legal team handle everything.

Monthly Payments via PDA

Once the consent order is granted, you begin making a single monthly payment to a Payment Distribution Agency (PDA). The PDA is an independent, regulated entity that distributes your payment to all your creditors according to the court order.

You do not need to manage multiple payments or deal with creditors directly. The PDA handles everything and provides you with monthly statements showing your progress.

Your debt counsellor continues to manage your case through ongoing after-care — handling creditor queries, monitoring your account, and helping if your circumstances change.

Clearance Certificate

Once all your debts are paid in full, your debt counsellor issues a clearance certificate (Form 19). This is the official document that confirms you have completed debt review and are debt-free.

The debt review flag is removed from your credit profile at all credit bureaus. You are free to apply for credit again, and your credit record begins to recover.

Many clients describe receiving their clearance certificate as one of the most freeing moments of their lives.

What Makes DS4U Different?

Complete your entire assessment and application via WhatsApp — no office visits or paperwork.

Begin your debt review on the same day you contact us. No waiting periods.

Debt Review Awards 2023, 2024 & 2025. 5-star rated on HelloPeter and Google.

One debt counsellor manages your case from start to finish — you always know who to contact.

Frequently Asked Questions

How long does the debt review application process take?

The initial application and assessment can be completed in a few days. Notification to creditors happens within 5 business days. The full process of getting a consent order can take 60 to 90 days. With DS4U's WhatsApp-first process, the application itself can be completed in under an hour.

Can I speed up my debt review?

Yes. You can make additional payments (such as from a bonus or tax refund) to pay off debts faster. Once a debt is settled, that payment is redirected to other creditors. Some clients complete debt review in less than 3 years this way.

What documents do I need for debt review?

You will need your South African ID, latest payslip or proof of income, 3 months of bank statements, and a list of all your credit agreements. Your debt counsellor will guide you through exactly what is needed.